Understanding Personal Finance

Personal finance refers to how you manage your money, including your income, expenses, savings, investments, and debt. It encompasses every aspect of financial planning and money management, from budgeting for daily expenses to planning for retirement.

Mastering personal finance empowers you to:

- Live within your means

- Avoid and eliminate debt

- Build savings for emergencies and future goals

- Invest for long-term wealth

- Reduce financial stress and increase peace of mind

Key Takeaways

- Few schools have courses on managing your money, so it is important to learn how through free online articles, courses, blogs, podcasts, or books.

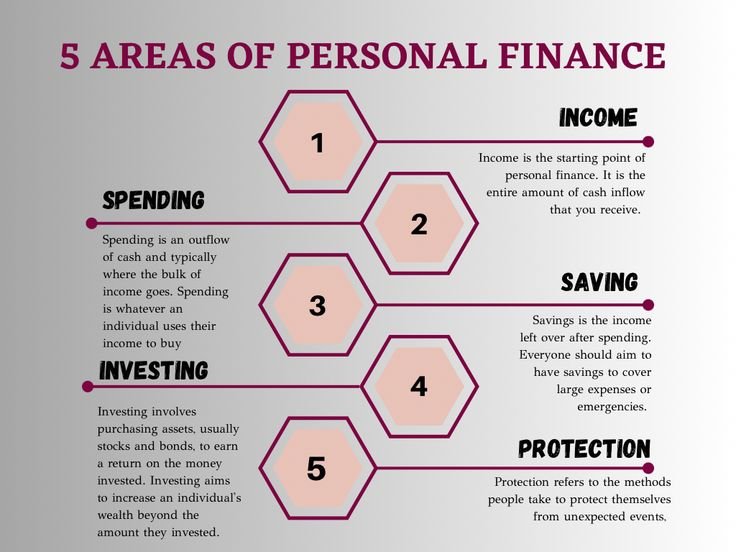

- The core areas of managing personal finance include income, spending, savings, investments, and protection.

- Smart personal finance involves developing strategies that include budgeting, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, and much more.

- Being disciplined is important, but it’s also good to know when you shouldn’t adhere to the guidelines.

What Is Personal Finance?

Personal finance is a term that covers managing your money as well as saving and investing. It encompasses budgeting, banking, insurance, mortgages, investments, retirement, tax, and estate planning. The term often refers to the entire industry that provides financial services to individuals and households and advises them about financial and investment opportunities.

Individual goals and desires—and a plan to fulfill those needs within your financial constraints—also impact how you approach the above items. To make the most of your income and savings, it’s essential to become financially savvy—it will help you distinguish between good and bad advice and make intelligent financial decisions.

The Importance of Personal Finance

Personal finance is about meeting your personal financial goals. These goals could be anything—having enough for short-term financial needs, planning for retirement, or saving for your child’s college education. It depends on your income, spending, saving, investing, and personal protection (insurance and estate planning).

- Credit card debt: Up by $24 billion

- Auto debt: Up by $18 billion

- Student debt: Up by $21 billion

- Mortgage debt: Up by $75 billion

- Home equity line of credit: Up by $7 billion

Budgeting – Your Financial Blueprint

A budget is the foundation of sound financial management. It tells your money where to go instead of wondering where it went.

Why Budgeting is Important

- Gives you control over your money

- Helps track income and expenses

- Identifies wasteful spending

- Sets limits and boundaries

Creating a Budget

- Calculate Your Income: Start with your total monthly income, including salary, freelance work, side gigs, etc.

- List Your Expenses: Break them into two categories:

- Fixed Expenses: Rent, mortgage, utilities, insurance

- Variable Expenses: Groceries, entertainment, eating out, shopping

- Set Spending Goals: Allocate amounts for each category based on priorities.

- Track and Adjust: Use budgeting tools or apps (like Mint, YNAB, or EveryDollar) to monitor your spending and make adjustments.

Popular Budgeting Methods

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt repayment

- Zero-Based Budgeting: Every dollar is assigned a job

- Envelope System: Use cash for different categories to control spending

Areas of Personal Finance

The five areas of personal finance are income, saving, spending, investing, and protection.

Income

Income is the starting point of personal finance. It is the entire amount of cash inflow that you receive and can allocate to expenses, savings, investments, and protection. Income is all the money you bring in. This includes salaries, wages, dividends, and other sources of cash inflow.

Spending

Spending is an outflow of cash and typically where the bulk of income goes. Spending is whatever an individual uses their income to buy. This includes rent, mortgage, groceries, hobbies, eating out, home furnishings, home repairs, travel, and entertainment.

Being able to manage spending is a critical aspect of personal finance. Individuals must ensure their spending is less than their income; otherwise, they won’t have enough money to cover their expenses or will fall into debt. Debt can be devastating financially, particularly with the high interest rates credit cards charge.

Saving

Savings are the income left over after spending. Everyone should aim to have savings to cover large expenses or emergencies. However, this means not using all your income, which can be difficult. Regardless of the difficulty, everyone should strive to have at least a portion of savings to meet any fluctuations in income and spending—somewhere between three and 12 months of expenses.

Beyond that, cash idling in a savings account becomes wasteful because it loses purchasing power to inflation over time. Instead, cash not tied up in an emergency or spending account should be placed in something that will help it maintain its value or grow, such as investments.

Investing

Investing involves purchasing assets, usually stocks and bonds, to earn a return on the money invested. Investing aims to increase an individual’s wealth beyond the amount they invested. Investing does come with risks, as not all assets appreciate and can incur a loss.

Investing can be difficult for those unfamiliar with it—it helps to dedicate some time to gain an understanding through reading and studying. If you don’t have time, you might benefit from hiring a professional to help you invest your money.

Protection

Protection refers to the methods people take to protect themselves from unexpected events, such as illnesses or accidents, and as a means to preserve wealth. Protection includes life and health insurance and estate and retirement planning.

Personal Finance Services

Several financial planning services fall under one or more of the five areas. You’re likely to find many businesses that provide these services to clients to help them plan and manage their finances. These services include:

- Wealth management

- Loans and debt

- Budgeting

- Retirement

- Taxes

- Risk management

- Estate planning

- Investments

- Insurance

- Credit cards

- Home and mortgage

Financial Habits for Long-Term Success

Developing good money habits is crucial for financial wellness:

- Live below your means

- Pay off credit card balances monthly

- Build credit wisely

- Review your finances regularly

- Avoid lifestyle inflation

- Stay educated about personal finance trends

Investing – Grow Your Wealth

Saving helps you preserve money, but investing helps it grow. Investing is essential for long-term wealth building and outpacing inflation.

Why You Should Invest

- Builds wealth

- Beats inflation

- Helps achieve long-term goals (retirement, education, etc.)

- Generates passive income

Basic Investment Options

- Stocks: Shares in a company, potential for high returns

- Bonds: Loans to companies/governments, lower risk

- Mutual Funds: Pooled investments managed by professionals

- ETFs (Exchange-Traded Funds): Similar to mutual funds, but trade like stocks

- Real Estate: Property investment for rental income or appreciation

Investment Accounts

- 401(k): Employer-sponsored retirement plan, often with matching

- IRA (Traditional/Roth): Individual Retirement Accounts with tax advantages

- Brokerage Accounts: General investing with no tax advantages

Tips for Smarter Investing

- Start early to harness compound interest

- Diversify your portfolio

- Invest consistently, regardless of market fluctuations

- Avoid trying to time the market

- Understand your risk tolerance

Also Read : How Do Startups Navigate The Complex World Of Business Finance?

Conclusion

Mastering personal finance doesn’t require a finance degree. With a solid budget, regular savings, and smart investing, you can take control of your financial life. Start small, stay consistent, and make financial literacy a priority. Over time, these small steps will lead to big rewards.

FAQs

1. How much should I save each month?

Aim to save at least 20% of your income, but any amount is a good start. Adjust based on your goals and expenses.

2. What’s the difference between saving and investing?

Saving is setting money aside in safe, liquid accounts for short-term needs. Investing is using money to buy assets like stocks or real estate to grow wealth over time.

3. When should I start investing?

The earlier, the better. Starting young gives your investments more time to grow through compounding.

4. How can I stick to a budget?

Use budgeting apps, set realistic goals, and review your budget regularly. Automate bill payments and savings.

5. What’s an emergency fund and why do I need one?

It’s a financial safety net for unexpected expenses like job loss or medical bills. It prevents you from going into debt.

6. Should I pay off debt or invest first?

Prioritize high-interest debt. After that, consider a balanced approach—invest while paying down lower-interest debt.

7. Do I need a financial advisor?

Not always. For simple finances, self-education and digital tools may suffice. For complex situations, a certified advisor can help.